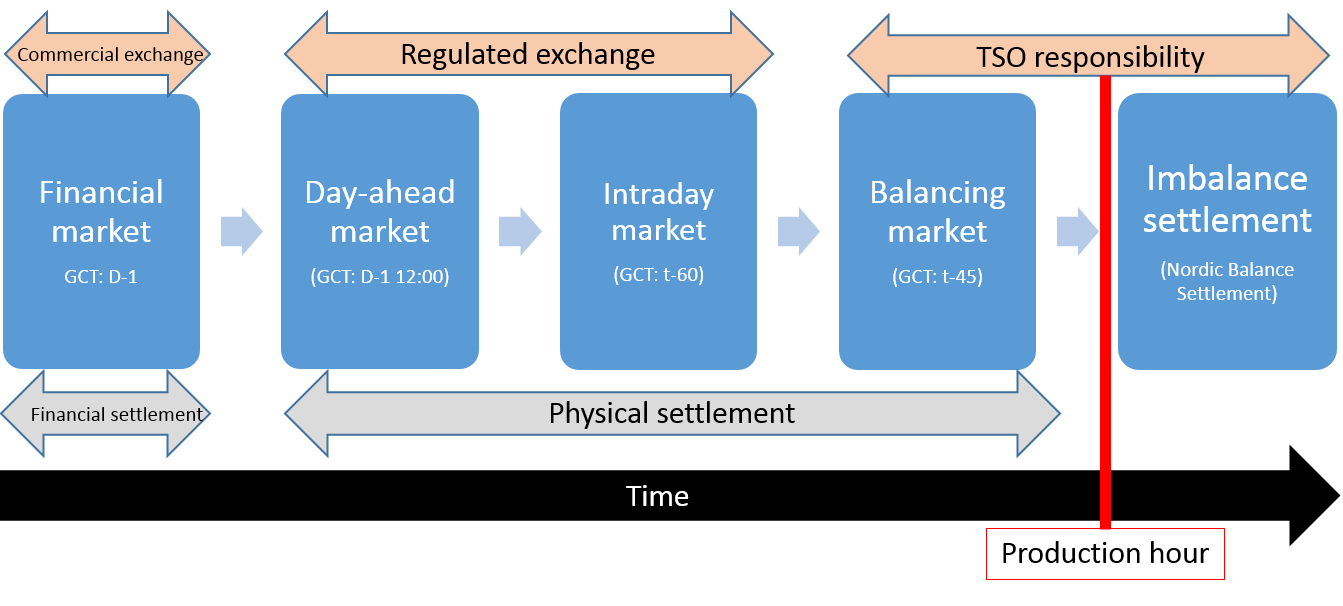

The financial forward market is regulated by the Financial Supervisory Authority of Norway and is placed under financial legislation. Because of the close interlinkage between the financial and the physical markets, this market timeframe is of importance to NVE-RME. A well-functioning financial market and trade with power derivatives is important for market participants in the physical power market because it allows them off-set their positions and hedge future income to adjust their risk profile. The financial market enables market participants to secure their positions months or even several years ahead of the delivery day.

The Day-Ahead Market (DAM) closes at 12:00 PM: 12-36 hours, before physical delivery is scheduled to take place. In the Nordic region, the power exchanges Nord Pool and EPEX SPOT offer trading services for DAM. The trading happens through a so-called implicit auction where price and volume are calculated for every hour for the following day. This auction is based on bids from both producers and consumers, and takes into account physical constraints of cross-zonal capacity. By setting price and volume for each bidding zone, the auction also determines the scheduled day-ahead flows between bidding zones. The system operators rely on the market clearing results when planning next day’s operation of the grid.

The Nordic system price is calculated based on the DAM results, represents the unconstrained equilibrium price, i.e. by assuming there are no congestions in the Nordic transmission grid. This price is used as reference for price setting in the financial market, as well as for bilateral contracts and retail contracts in the market. The area specific prices, i.e. the Day-Ahead price for each bidding zone take into account the restrictions in the transmission grid. These capacities are given daily (10:00 AM) by the TSOs.

The Intraday Market opens three hours after the Day-Ahead Market closes. Nord Pool and EPEX SPOT offer trading services for the Intraday Market. Different to the DAM, the intraday market has continuous trading. The intraday market supplements the DAM and market participants can trade until one hour before the production hour in order to correct possible imbalances (such as if it becomes colder or more windy than anticipated) up until one hour before time of production. The market participants can trade between bidding zones if capacity is available.

The balancing markets are operated by the TSO, Statnett, who is responsible for balancing the system. The balancing markets can be divided into primary reserves (FCR), secondary reserves (aFRR) and tertiary reserves (mFRR). FCR and aFRR are activated automatically while mFRR is activated manually. Furthermore, FCR is the fastest, while mFRR is the slowest with a response deadline of 15 minutes. mFRR is activated depending on need and with an hourly price resolution. Gate closure time for bids in the balancing market is 45 minutes before time of production, but since mFRR has a response time of 15 minutes, activation can happen within the production hour. In the Nordics, there is a common market for mFRR (common Nordic merit order list). When cross-zonal capacity is available, this enables activation cheaper resources and a more efficient dispatch of balancing resources.

The imbalance settlement takes place after the operational hour and is a TSO responsibility. Esett OY will carry out this task when in operation by the end of 2016. Esett OY is jointly owned by the Norwegian, Swedish and Finnish TSOs and will conduct imbalance settlement on behalf of these TSOs. More information on Nordic Balance Settlement and Esett OY can be found here.

Bilateral contracts and the power exchange: A bilateral contract in the wholesale market is a market based contract between a buyer and a seller with an agreed price, volume and time period. Traditionally, participants in the wholesale market bought and sold electricity through bilateral physical contracts (short and long-term). The Energy Law, which entered into force in 1990, resulted in the development towards trading on the power exchange and away from the physical bilateral contracts. However, there are many bilateral long-term contracts in the market, but most of these are financially settled. Over 90 % of the physical power consumed in the Nordic area is traded through power exchanges in the Day-Ahead Market.